My Bitcoin Thesis for 2021 and Beyond

Bitcoin is the best method for storing value that the world has ever created.

Since 2017's market growth, I've spent time watching Bitcoin and studying it as much as I possibly can. I started investing before the peak of that cycle and continued through the "bear" market from 2018-2020.

I wanted to share my current thesis with you, with the caveat that there's no chance I will be 100% correct, and it's possible that I'm wildly off the mark. Note that is this also not my own thinking, rather a synthesis of a large quantity of other smart people in the space.

I do believe, however, that I and other Bitcoin investors are directionally correct, and in this case, being directionally correct has massive implications.

And, that if this thesis is correct, then I believe this is a moment in time right in which you can make a decision today that will transform the opportunity for you tomorrow.

Money is stored energy, and we pass it to ourselves through time for some future date when we need it.

When we store our money in dollars, in homes, in savings accounts, in stocks, in cars, in art...that money can appreciate, depreciate or hold steady to it's nominal level of price.

The problem we face as we have excess capital to store for later is where to put that money?

This is the basis of investing.

Bitcoin is the best method for storing value that the world has ever created.

It is a network effect driven money platform that allows instant transfer of wealth across the world for very little fees. It is a technology and an invention – an open, global financial network that is similar to the internet in its simplicity, robustness, and scale.

It is a parallel internet, an internet of money.

And it goes beyond that.

But for this moment in time, the current growth of the Bitcoin blockchain is going through a phase based on Bitcoin's "Gold-like" thesis of being a store of value for people looking to keep their wealth in a non-dilutive, tamper proof mechanism.

The Bitcoin network is decentralized, meaning it exists outside of any government, any institution, or any one person. It's achieved a network scale and current value of more than almost any business on earth within 12 years.

Once the network was turned on, it has not (and will not) be turned off.

This is just the beginning.

The Bitcoin network itself has the most elegant design of almost anything I've ever seen. You can read the white paper here.

While the code itself is changeable and can be "forked" at any time – It relies on leaning into human incentives to perpetuate a simple set of rules that would take unimaginable shifts of millions of separate, coordinated entities to personally destroy their own wealth in order to change or tamper with the system.

Without going into too much detail, part of the security and growth mechanism design relies on miners to "mine" new Bitcoin, showing proof of expended energy (proof of work), to gain access to "newly minted" Bitcoin similar to how miners dig for gold, instead this all happens digitally. This simultaneously secures the network (processing blocks) while adding new Bitcoin supply to the market.

The genius of the system is that every 4 years, based on the code-base, that "flow" of newly minted Bitcoin that comes onto the market through miners is cut in half.

This "halving event" means that every 4 years, it is programmed to release half as much new "flow" onto the market. This makes Bitcoin inelastic. Just because more people demand it, does not mean you can make any more of it. If demand is constant, the non-held new supply is diminishing.

What you have is an engineered money network distributing rewards to those bootstrapping the network into existence through mining and purchasing, on a predictable supply schedule.

Ultimately the cherry on top of the elegance of Bitcoin was capping the total supply of Bitcoin to 21 Million coins.

By having a fixed supply of total Bitcoin to ever be minted, all participants in the network are coordinating on a fixed supply schedule. This guarantee allows for an alignment of incentives and coordination never before seen with money.

We are used to governments printing fiat dollars, increasing the money supply, or generally making decisions about monetary policy that effect the supply.

We are used to humans in government making these changes at their own whims!

Instead, Bitcoin is decentralized with a fixed ruleset that makes the money itself deflationary – that is the supply is diminishing rather than growing.

This diminishing property of this money scarcity produces an effect; a "post-halving" event by which there is a mechanistic supply shock.

This shock, cutting supply in half, skyrockets the price if demand is constant. It also makes the network itself look wildly predictable.

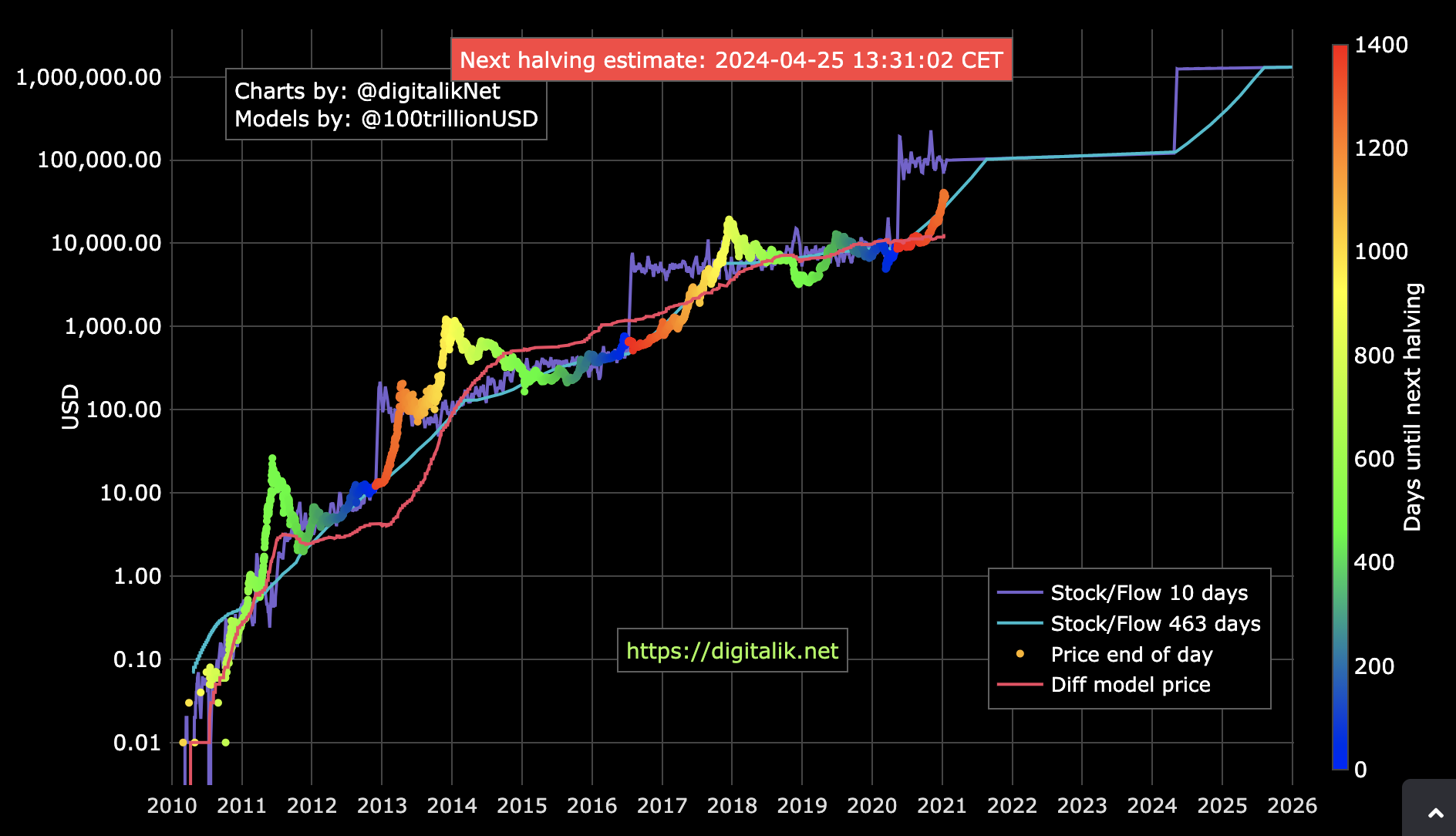

These charts are beautiful, when you look at them as adoption of this new money network. Think of it not like a stock, but more as a technology adoption curve.

See how there is a rhythm to the network, and how each cycle looks like the previous.

This "heartbeat" like rhythm happens at the boom and bust cycles.

There is debate about whether or not this cycle of chart continues permanently.

Or whether it will continue beyond today, but you can see the history, and use it to imagine how it could play out into the future.

Thing to note about the price rise that right after cutting supply in half, the Bitcoin supply/demand economics are inelastic.

We are used to basic supply and demand economics. When something is demanded by a market, you make more supply to meet that demand.

Bitcoin has a fixed supply, and a growing demand.

Here's a great letter from Pantera about the "Bitcoin Shortage": https://panteracapital.medium.com/bitcoin-shortage-172a9205dc0

Nothing I'm saying is new to current market participants.

But to those unaware I believe they are missing the birth of a new internet that they can invest in and reap benefits from if they keep a long time horizon and act wisely.

If you understood the chart above, you can see that we are now a good 7 months past the last 4 year halving cycle.

What this means is that we are currently in a bull market that will likely last until the end of 2021. Each cycle has produced a massive run up in price, and I predict we will see a doubling to a 5-10x of price from here.

Note that in every major run up in price, the exuberance of the market has created a "bubble" like effect in which the price ramps up beyond it's value and crashes down, often by a hair raising 70%.

Do not be fooled by these massive swings in price, however, simply zoom out and notice the yearly price appreciation. These massive swings are the swings of the market trying to price something so large that it is incredibly difficult to price correctly in its infancy. This is akin to investing directly into the idea of "the internet" and trying to price it. It would be impossible without large swings in people's belief.

If you can zoom out, and sit out from trading your Bitcoin and instead simply hold it a longer duration through multiple cycles, I believe that you can take part in this network appreciation by simply HODLing (Hodl is a meme for "hold" from Crypto Twitter).

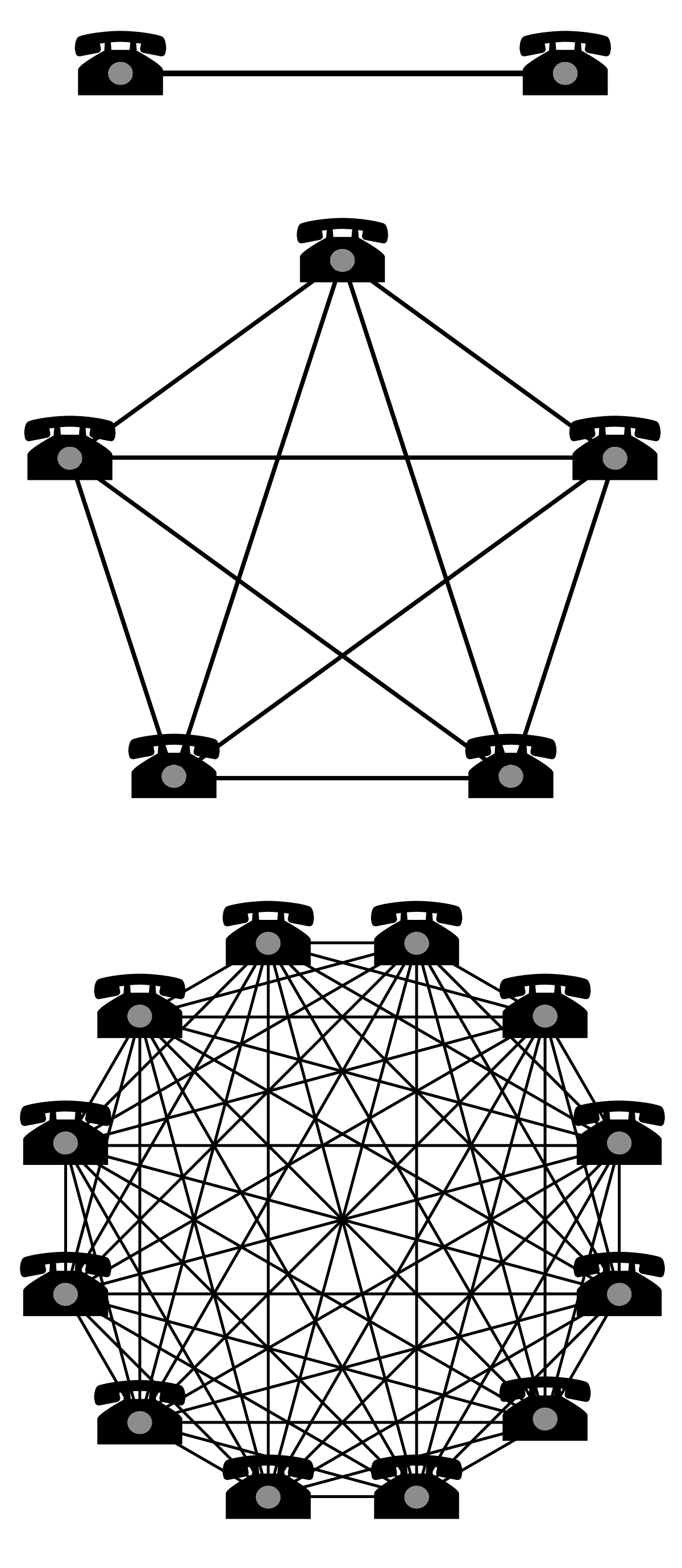

Note: the network itself is getting more valuable over time. Metcalfe's law simply states that the more nodes in a network (such as email, fax, or cell phones) the more valuable the network is. Basically, it's better for you if everyone has a cell phone, than if only 5 people do (the experience improves).

Bitcoin has been steadily improving due to its adoption, but also do to the services and products being built around it. For example, adoption by financial services like Paypal and Square have increase Bitcoin's utility by allowing more users to onboard onto the network.

My TLDR for this essay is this:

- Due to the halving event in May 2020 we're in the middle of a new bull cycle.

- If Bitcoin continues its trajectory, my guess is that at some point of 2021 we'll see prices somewhere in the doubling or more of its current price.

- There will be a sharp drawdown of 50%+ after this peak exuberance. Don't' freak out. Hold.

- We will hover in the ~$40,000-$100,000 range for a few years while the market recovers. Maybe more maybe less.

- Once again the halving event will kick off another massive bull run taking the price way beyond previous highs.

- And so on this will continue until, I believe, it overtakes Gold's market cap of 10 Trillion, and potentially becomes the base layer of how we price all internet transacted goods and services.

The point of this essay is to describe the nature of this new internet of money, the Bitcoin blockchain and how it is emerging as a global technology that will reshape finance.

This post itself is extremely high-level but the point I want to draw for you is to understand what is happening enough to decide whether or not to participate.

It is better to understand and have the choice, then to miss it without being able to make one.

Everyone needs to take their current stage of life, liquidity, savings, and risk tolerance into account while investing in Bitcoin.

There are plenty of risks – government intervention, taxation, hacks... but I believe that the upside is so large that there is a prudent risk reward calculation to be made. Many people offer the idea of having just 2-5% of your net worth in Bitcoin, being that the upside is so large, and the downside wouldn't be earth shattering.

Personally, I believe that owning 1/3, 1/2, or even ONE full Bitcoin can produce life-altering capital if held for the next decade.

As I stated in the beginning, money is simply a way we track and transmit value.

Bitcoin is the best storage system and ledger for storing and transferring value we've ever come up with as a species. It is a global money network.

Bitcoin is for everyone. You can use it any time and buy it at any fraction of a coin.

To send yourself or your family money into the future through this Bitcoin mechanism (which appreciates in value as the supply decreases) can produce a financial result beyond any other asset available to us in the world today.

Creative Caffeine Newsletter

Join the newsletter to receive the latest updates in your inbox.